Auto Insurance in and around Portland

Portland! Are you ready to hit the road with auto insurance from State Farm?

Let's hit the road, wisely

Would you like to create a personalized auto quote?

You've Got Things To Do. Let Us Help!

Whether it's a pickup truck or a sedan, your vehicle could need outstanding coverage for the necessary work it contributes to keep you moving. And especially when the unanticipated happens, it can be important to have the right insurance for this significant part of your daily living.

Portland! Are you ready to hit the road with auto insurance from State Farm?

Let's hit the road, wisely

Your Search For Auto Insurance Is Over

The right options may look different for everyone, but the provider can be the same. From emergency road service coverage and liability coverage to savings like Drive Safe & Save™ and an anti-theft discount, State Farm really shifts these options into gear.

Auto coverage like this is what sets State Farm apart from the rest. State Farm is there whenever the unexpected happens to handle your claim promptly and reliably. State Farm has coverage options to get you wherever you are going from day to day.

Have More Questions About Auto Insurance?

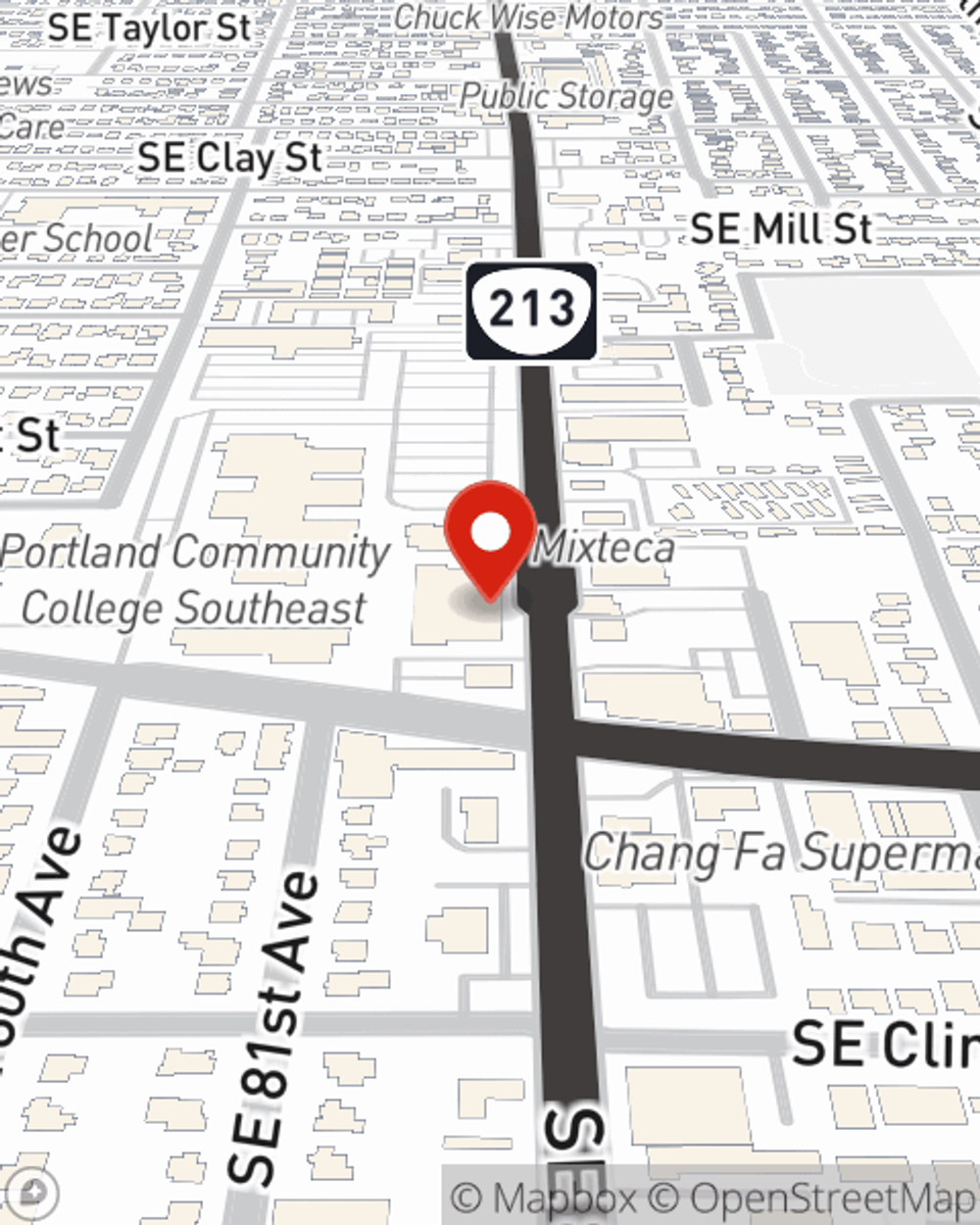

Call Tiffany at (503) 252-7095 or visit our FAQ page.

Simple Insights®

How likely are you to have an animal collision?

How likely are you to have an animal collision?

What can you do to avoid hitting animals when driving? This animal collision study from State Farm ranks states by the chance potential drivers had of hitting an animal.

When do you need an international driver's license?

When do you need an international driver's license?

Learn how to legally drive with an international driver's license while in a foreign country.

Tiffany Kim

State Farm® Insurance AgentSimple Insights®

How likely are you to have an animal collision?

How likely are you to have an animal collision?

What can you do to avoid hitting animals when driving? This animal collision study from State Farm ranks states by the chance potential drivers had of hitting an animal.

When do you need an international driver's license?

When do you need an international driver's license?

Learn how to legally drive with an international driver's license while in a foreign country.